If you want to trade in commodities or currencies, you’ll want to follow the wall street mantra of buy low sell high. If you want to arbitrage a stock or currency, you need to buy it in one trading pool for low, transfer it to a new pool, and sell it for more than you bought it minus the transaction costs.

But there’s a third way; you can trade against the volatility of different exchanges. Even if the fees to arbitrage make arbitraging unprofitable, you can still trade against the rate of price changes in different trading pools, selling bitcoin when it’s expensive and returning it when it’s cheap.

To understand what I mean we’ll have to go back a few years, specifically back to 2013. At the time bitcoin was all the rage, it had just started to break onto newspapers but not yet cable TV, and I was in high school learning C on an old Dell. I didn’t particularly believe in the future of Bitcoin but I loved the idea. The tech was cool but I believed international currencies were more competitive and stable than cryptocurrencies could ever be in an unregulated form. As much as I hate to admit it, good authoritarians are generally better than the best democracy’s, and in this case I didn’t think and continue to believe a community can not set inflation targets or manage currency supply as well as the Federal Reserve or other central banks. This didn’t really matter too much though as the tech was here and there was still opportunities in the space.

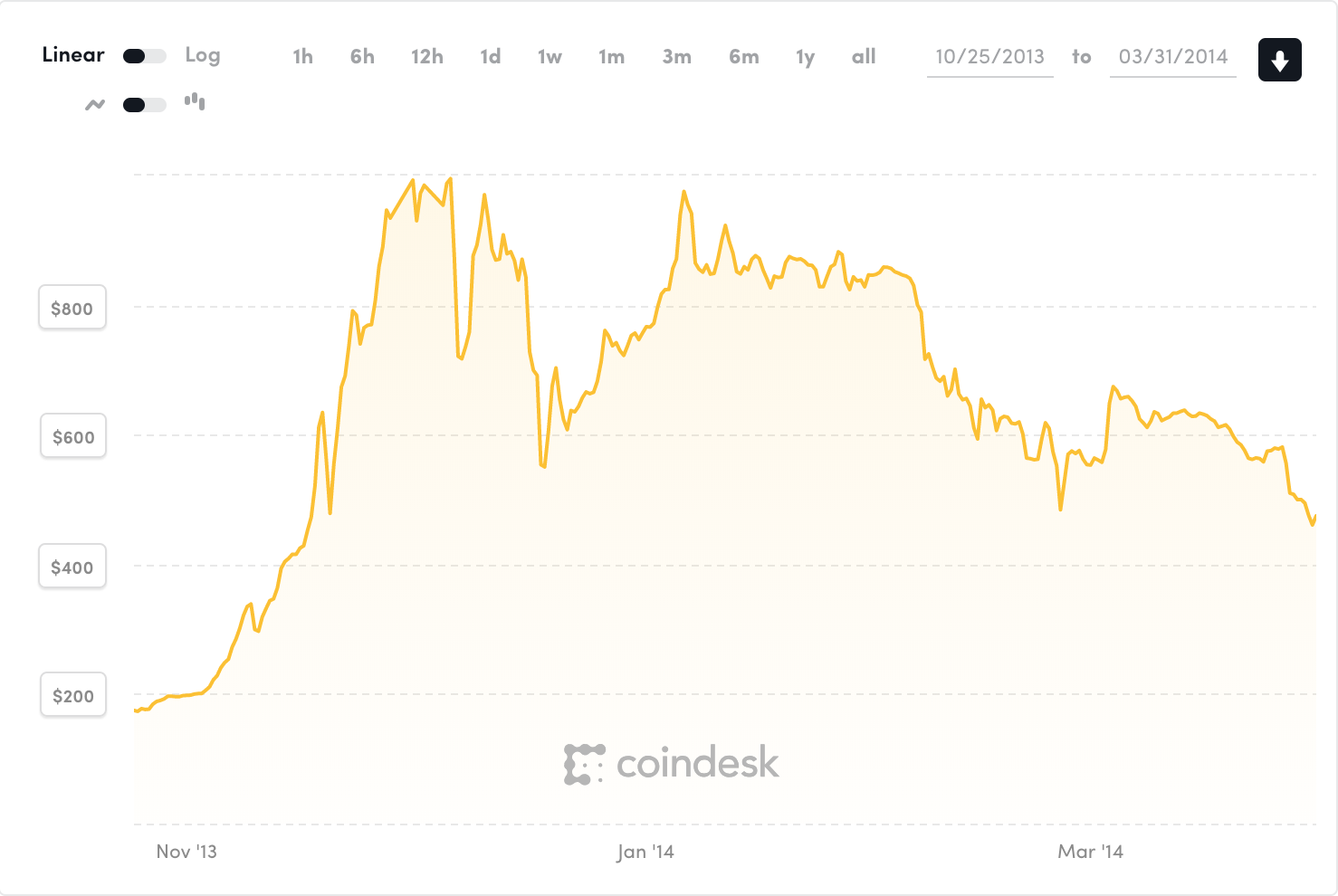

At the time, bitcoin was “going to the moon” as people in the community would say, and it had grown from a couple bucks for a coin to a few hundred. I didn’t want to directly invest in it, it felt too much like a bubble, however I did really like the idea of arbitraging it. I set to work writing a program in C to find the best arbitrage opportunities, but I soon discovered that the API’s weren’t ready and frankly neither was I. Studying the different bitcoin markets however I did notice something odd. MtGox, the largest exchange at the time and based in Japan, would always lead the market when prices went up. Often, they would increase just a little faster than the rest of the market but they’d level off at the same price. The issue however is that MtGox being a Japanese exchange, it’s very difficult to get money in or out of the country. In fact it’s partly this difficulty that causes the price differences (and possibly some mischief on behalf of MtGox, but that’s another story). You have to wait days and pay fairly large percentages. You can arbitrage it but it’s not easy, and the fees to transfer money out of the country made it all but unprofitable.

What I guessed correctly though was I could still make money off this price difference. I could purchase a bitcoin from Coinbase (which acted more like a bank with a stable price) while the market was rising, transfer it to a MtGox account, and exchanged it into usd, collecting the difference from the market volatility. From there I’d simply wait for the price difference to shrink and do the same thing in reverse, purchasing a btc, transferring it to Coinbase, and exchanging it back into usd. This pattern would repeat every week or couple of days, and I could make 50 to 110 usd for every bitcoin I transferred; essentially free money.

If you remember the story of MtGox you probably know what’s going to happen next – the exchange went insolvent. Someone had stolen 450 million usd worth of btc, depleting their asset reserves and eventually pushing the company towards insolvency. By coincidence the same day I had tried to transfer btc back to Coinbase was the day people started reporting issues on Reddit about the exchange, and MtGox came clean about the issue a short while later.

MtGox is gone but the idea still remains, and it’s one that’s not discussed much in cryptocurrency arbitrage as far as I can tell. Cryptocurrencies provide the unique opportunity to trade assets for very little transaction costs, allowing you to skirt under more traditional cost barriers to arbitration. Although I’m out of the market the opportunity to make money is still there, even though it it’s lost its most volatile exchange.